|

|

| |

Late September/Early October 2015 SEE Monthly Update -

Whale Watch: Dividend Hunting at Integrated Internationals

While attention is focused on each oil price change, major factors affecting oil and gas oversupply (and lessened demand in the case of oil) likely won't vary much in the next few months. Moreover, the lower-demand season for oil has begun. As fellow investors reminded me, it's now worth taking a look at stable, dividend-paying stocks.

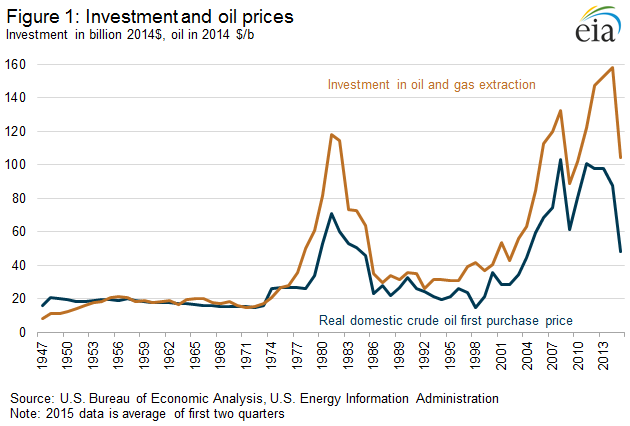

The oil industry has cut an estimated 200,000 jobs since the downturn began less than a year ago. From the capital side, Wood Mackenzie estimates that up to $1.5 trillion of planned oil and gas spending on conventional and North American shale oil projects will be delayed if prices stay below $50 per barrel. In its 9/23/2015 issue of This Week in Petroleum, the Energy Information Administration (EIA) provides a chart showing a close correlation between oil prices and investment in oil and gas extraction:

The EIA estimates October 2015 U.S. shale oil production will be down 80,000 barrels per day (BPD) out of 5,286,000 BPD, or 1.5%. Note that total U.S. oil production was 9.3 million BPD at the end of June, down from a high of 9.6 million BPD in April. To paraphrase a saying, the market will eventually turn higher but some companies will run out of cash waiting for the upturn.

Advertisement: For those who haven't yet read it, a quick mention of the first Lynn Dayton oil thriller. After an 18-month hiatus, 13 Days: The Pythagoras Conspiracy, about a plot to sabotage refineries and the woman who must discover and stop it, is back out in e-book formats—Kindle, Nook, and Apple iBooks in the US along with Amazon and Kobo overseas (Australia-Collins; France and much of Europe-FNAC; Canada-Indigo and Amazon; India-Amazon; and Italy-Feltrinelli).

Amazon for the Kindle e-book

Barnes & Noble for the Nook e-book

Kobo

For more on this topic log in now or, if you are not already a subscriber, subscribe now.

Copyright 2015, Starks Energy Economics, LLC. This information is confidential and is intended only for the individual named. This information may not be disclosed, copied or disseminated, in whole or in part, without the prior written permission of Starks Energy Economics, LLC. This communication is based on information which Starks Energy Economics, LLC believes is reliable. However, Starks Energy Economics, LLC does not represent or warrant its accuracy. This communication should not be considered as an offer or solicitation to buy or sell any securities.

I, Laura Starks, do hereby certify that, to the best of my knowledge, the views and opinions in this research report accurately reflect my personal views about the companies and their securities as of the date of this report. These viewpoints and opinions may be subject to change without notice and Starks Energy Economics, LLC will not be responsible for any consequences associated with reliance on any statement or opinion contained in this communication.

- Enduring the Downturn; Bakken Resilience - August 2015

- California Refiners - July 2015

- Bakken Producers, US vs. OPEC vs. Russia, Epstein book - June 2015

- Investor Momentum, Oklahoma Earthquakes, Bakken Rail Transport - May 2015

- Regulatory Changes, Earthquakes, and Proppant Companies - April 2015

- Oil Field Services Stress Tested - February 2015

- Haynesville, Louisiana Dry Natural Gas Field - January 2015

- Is the Permian a Bargain Basin Yet? - December 2014

- Starks Energy Economics on Natural Gas - 4th quarter 2014

- Eagle Ford Energy - 3rd quarter 2014

- The Power of the Permian - 2nd quarter 2014

- Ethylene, Star Petrochemical with Renewed Luster - 1st quarter 2014

- Pipeline Drag Reducers - 4th quarter 2013/1st quarter 2014

- Signal vs. Noise: Energy Sources Fueling the United States Now - 3rd quarter 2013

- Natural Gas: Heating, Electricity, Industrial Use, Transport Fuel, Export, or All of the Above? - 2nd quarter 2013

- Besides Better Weather, What Does It Take to Operate an Oil Refinery on the US East Coast? - 1st quarter 2013

- Oil Industry in North Dakota Continues Booming - 4th quarter 2012

- Low First-Half Natural Gas Prices Help Clean the Air - 3rd quarter 2012

- Permian Basin, West Texas and New Mexico - 2nd quarter 2012

- US MidContinent Refineries - 1st quarter 2012

- North Dakota's Bakken Oil Shale Production - 4th quarter 2011

sitemap | home | contact us | bio | links | events

|

|

|