|

|

| |

November 2015 SEE Monthly Update -

Permian Persistence, Part I

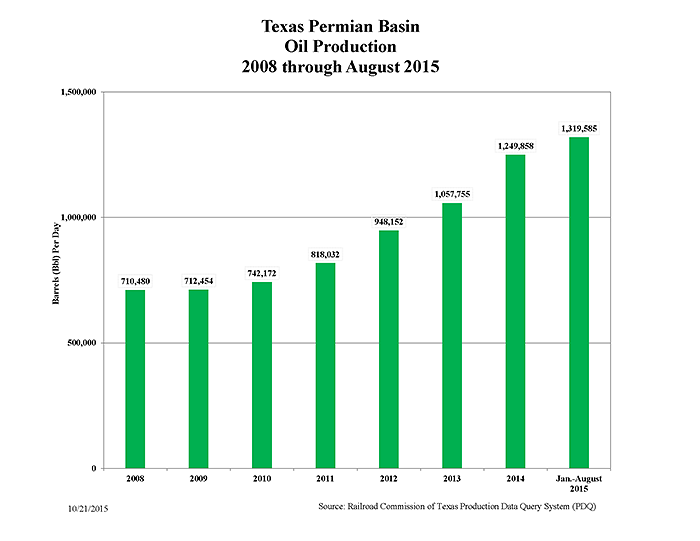

The Permian Basin in west Texas and eastern New Mexico is one of the last areas in which horizontal drilling began. It has already produced oil for decades. Even during the lowest prices, many vertical Permian wells remained profitable.

Because of its vast depositional sea, stacked pay, pipeline infrastructure, and critical mass of talent and organizations, the Permian Basin remains one of the lowest-cost areas in the US in which to drill for oil. As a consequence, the operational and financial momentum developed by the boom in unconventional drilling now focuses on the Permian as rig counts and development decline in other, less-prolific and less oil-prone US plays.

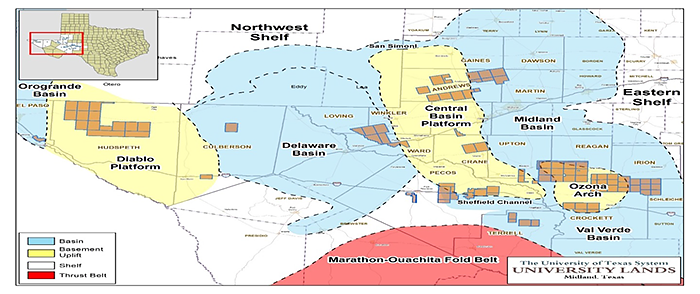

An interesting and unusual Permian entity continues to be the University of Texas University Lands Office (ULO). Texas University Lands' history dates back to 1838 and its first oil discovery occurred in 1923. Revenues from the University Lands go to the Permanent University Fund (PUF), with one-third allocated to the Texas A&M system and two-thirds to the University of Texas system.

Source: Mark Houser, Chief Executive Officer, University Lands Office

Source: Mark Houser, Chief Executive Officer, University Lands Office

In addition to oil leasing, University Lands' surface activities include pipeline and power line easements, grazing, ranching, hunting, wind farms, a winery, airports, public schools, and water sales. The entire PUF had a market value of $17.4 billion as of August 2014 and annual revenues from University Lands to the PUF reached over a billion dollars in 2014.

The ULO's new chief, Mark Houser, has oil company experience. He is hiring technical staff so the office can take a better-informed role in assessing its 2.1 million acres, including its 9000 active wells and 220,000 barrels of oil equivalent per day (BOE/D) of oil and gas production. ULO will continue to leave actual operations to over two hundred for-profit partner companies like Devon, Pioneer, and Apache.

Two points of particular note: horizontal drilling in the Permian developed first on University Lands because it has so much contiguous acreage. When companies are drilling 5000- to 8000-foot laterals, dealing with one owner for a few miles in each direction makes leasing faster and easier.

Second is that 1.5 million of the 2.1 million acres, or 71%, of University Lands are leased for drilling. In January 2016, the ULO expects to do a targeted lease sale of some of its Midland-area land, with a larger bid round occurring during the third quarter of 2016.

Source: Texas Railroad Commission

Source: Texas Railroad Commission

For more on this topic log in now or, if you are not already a subscriber, subscribe now.

Copyright 2015, Starks Energy Economics, LLC. This information is confidential and is intended only for the individual named. This information may not be disclosed, copied or disseminated, in whole or in part, without the prior written permission of Starks Energy Economics, LLC. This communication is based on information which Starks Energy Economics, LLC believes is reliable. However, Starks Energy Economics, LLC does not represent or warrant its accuracy. This communication should not be considered as an offer or solicitation to buy or sell any securities.

I, Laura Starks, do hereby certify that, to the best of my knowledge, the views and opinions in this research report accurately reflect my personal views about the companies and their securities as of the date of this report. These viewpoints and opinions may be subject to change without notice and Starks Energy Economics, LLC will not be responsible for any consequences associated with reliance on any statement or opinion contained in this communication. Members of Starks Energy Economics, LLC own securities of Approach Resources, Diamondback Energy, and Parsley Energy.

- Life at the Pumps: Gasoline Demand-Analysis in Two Graphs, October 2015

- Whale Watch: Dividend Hunting at Integrated Internationals, Late September/Early October 2015

- Enduring the Downturn; Bakken Resilience - August 2015

- California Refiners - July 2015

- Bakken Producers, US vs. OPEC vs. Russia, Epstein book - June 2015

- Investor Momentum, Oklahoma Earthquakes, Bakken Rail Transport - May 2015

- Regulatory Changes, Earthquakes, and Proppant Companies - April 2015

- Who is Hurt and Who Benefits from the Oil Price Drop? - March 2015

- Oil Field Services Stress Tested - February 2015

- Haynesville, Louisiana Dry Natural Gas Field - January 2015

- Is the Permian a Bargain Basin Yet? - December 2014

- Starks Energy Economics on Natural Gas - 4th quarter 2014

- Eagle Ford Energy - 3rd quarter 2014

- The Power of the Permian - 2nd quarter 2014

- Ethylene, Star Petrochemical with Renewed Luster - 1st quarter 2014

- Pipeline Drag Reducers - 4th quarter 2013/1st quarter 2014

- Signal vs. Noise: Energy Sources Fueling the United States Now - 3rd quarter 2013

- Natural Gas: Heating, Electricity, Industrial Use, Transport Fuel, Export, or All of the Above? - 2nd quarter 2013

- Besides Better Weather, What Does It Take to Operate an Oil Refinery on the US East Coast? - 1st quarter 2013

- Oil Industry in North Dakota Continues Booming - 4th quarter 2012

- Low First-Half Natural Gas Prices Help Clean the Air - 3rd quarter 2012

- Permian Basin, West Texas and New Mexico - 2nd quarter 2012

- US MidContinent Refineries - 1st quarter 2012

- North Dakota's Bakken Oil Shale Production - 4th quarter 2011

sitemap | home | contact us | bio | links | events

|

|

|