|

|

| |

October 2017 SEE Monthly Update

Midland Sub-Basin Producers

The Permian Basin, 250 miles wide and 300 miles long, remains the most economic and productive oil basin in the US, and it is world-competitive. Due to its stacked pay—from four benches to as many as twelve—producers consider “acreage” costs in terms of three-dimensional cubes rather than two-dimensional surface area. The Permian’s hydrocarbon column is three times as deep as Oklahoma’s Stack and ten times as deep as North Dakota’s Bakken.

Cumulatively, the Permian Basin has produced 28.9 billion barrels of oil and 75 trillion cubic feet of gas. Remaining hydrocarbon estimates range from 43 billion barrels of oil and 18 TCF of gas to much more.

The US Department of Energy’s most recent Drilling Productivity Report shows Permian Basin oil production of 2.6 million barrels per day (BPD) and gas production of 8.9 billion cubic feet per day (BCF/D). Permian’s oil production is more than twice as much as the next closest region, the Eagle Ford at 1.2 million BPD.

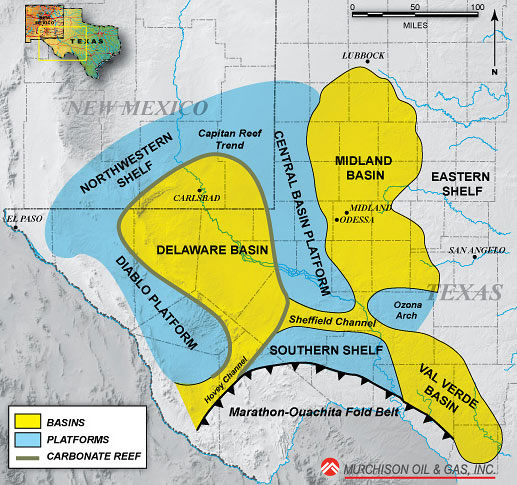

As the map above shows, the Permian has two “sides”—the traditionally-explored Midland sub-basin on the east, and the newer Delaware sub-basin to the west. In between is the Central Basin Platform, which is not prospective for hydrocarbons.

The Midland sub-basin has been drilled vertically to the Spraberry target since the 1940s. Producers thus benefitted from the data of these thousands of wells as they began drilling horizontally during the last several years. In addition to the Upper and Lower Spraberry, newer horizontal targets include the Wolfcamp A and B.

The subscriber section reviews public companies operating in the Midland sub-basin of the Permian Basin.

More information can be found in the subscriber section. For more information, log in now or, if you are not already a subscriber, subscribe now.

Copyright 2017, Starks Energy Economics, LLC. This information may not be disclosed, copied or disseminated, in whole or in part, without the prior written permission of Starks Energy Economics, LLC. This communication is based on information which Starks Energy Economics, LLC believes is reliable. However, Starks Energy Economics, LLC does not represent or warrant its accuracy. This communication should not be considered as an offer or solicitation to buy or sell any securities.

- Midland Sub-Basin Producers (10/2017)

- PADD III Gulf Coast Refineries Recover After Harvey, September 2017 (09/2017)

- Permian Cools Slightly, August 2017 (08/2017)

- Energy Mix, July 2017 (07/2017)

- Bakken off the Bottom: Resurgence Starting in North Dakota? June 2017 (06/2017)

- Chemicals Companies Benefit from More US Gas Production, May 2017 (05/2017)

- Permania, April 2017 (04/2017)

- Complex PADD III Gulf Coast Refineries Benefit, March 2017 (03/2017)

- Sand (and Proppant) Storm, February 2017 (02/2017)

- SEE PADD II & IV Refineries, January 2017 (01/2017)

- Permian Part II: Hottest Basin, and New Administration, December 2016

- Permian Basin Part I, Inventories, Election, November 2016

- Favorable Winds? Harvesting This Alt Energy Source No Longer Quixotic, October 2016

- Exploration Activity Focuses on Permian Basin, Earthquakes, September 2016

- Petroleum Market Suffers from Inventory Surplus, August 2016

- Many Still Producing Natural Gas in PA-OH Marcellus, Late June/July 2016

- Sand & Proppant Companies Squeeze Through Decline Funnel, June 2016

- Gulf Coast (PADD III) Refining, May 2016

- California Refining, April 2016

- Low Natural Gas Prices Benefit Utilities, March 2016

- Do Solar Energy Companies Shine?, February 2016

- Oil Export/Energy Bill Winners and Losers, January 2016

- Permian Persistence, Part II, December 2015

- Permian Persistence, Part I, November 2015

- Life at the Pumps: Gasoline Demand-Analysis in Two Graphs, October 2015

- Whale Watch: Dividend Hunting at Integrated Internationals, Late September/Early October 2015

- Enduring the Downturn; Bakken Resilience - August 2015

- California Refiners - July 2015

- Bakken Producers, US vs. OPEC vs. Russia, Epstein book - June 2015

- Investor Momentum, Oklahoma Earthquakes, Bakken Rail Transport - May 2015

- Regulatory Changes, Earthquakes, and Proppant Companies - April 2015

- Who is Hurt and Who Benefits from the Oil Price Drop? - March 2015

- Oil Field Services Stress Tested - February 2015

- Haynesville, Louisiana Dry Natural Gas Field - January 2015

- Is the Permian a Bargain Basin Yet? - December 2014

- Starks Energy Economics on Natural Gas - 4th quarter 2014

- Eagle Ford Energy - 3rd quarter 2014

- The Power of the Permian - 2nd quarter 2014

- Ethylene, Star Petrochemical with Renewed Luster - 1st quarter 2014

- Pipeline Drag Reducers - 4th quarter 2013/1st quarter 2014

- Signal vs. Noise: Energy Sources Fueling the United States Now - 3rd quarter 2013

- Natural Gas: Heating, Electricity, Industrial Use, Transport Fuel, Export, or All of the Above? - 2nd quarter 2013

- Besides Better Weather, What Does It Take to Operate an Oil Refinery on the US East Coast? - 1st quarter 2013

- Oil Industry in North Dakota Continues Booming - 4th quarter 2012

- Low First-Half Natural Gas Prices Help Clean the Air - 3rd quarter 2012

- Permian Basin, West Texas and New Mexico - 2nd quarter 2012

- US MidContinent Refineries - 1st quarter 2012

- North Dakota's Bakken Oil Shale Production - 4th quarter 2011

sitemap | home | contact us | bio | links | events

|

|

|